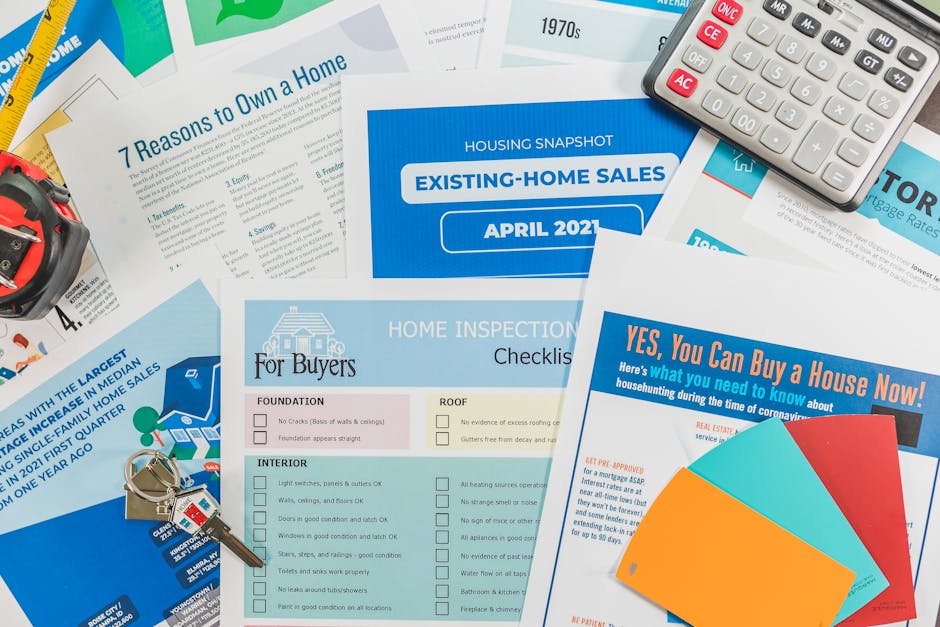

Existing home sales outlook improves as mortgage rates stabilize

Why the existing-home market may be turning a corner If you’ve been watching the housing market lately, you’ve probably noticed the same theme: lots of uncertainty, fewer listings than normal, and buyers and sellers trying to “wait out” higher rates. A recent outlook suggests that may finally be changing. With mortgage rates stabilizing and mortgage … Read more